Energy bills certainly don’t make for compelling reading, but if you want to understand what those confusing numbers mean for your business, getting a handle on the terms involved is important.

Breaking down your bill

No two invoices are the same, and it is likely that each energy supplier will have a different layout and often use different terminology on the bills they issue.

There are two key parts on your business energy bill that you can expect to see. The billing breakdown (usually on page 1) summarises your account balance and recent charges. It shows exactly what, and when, you need to pay. The second section (usually on page 2), the billing charges, breaks down the elements that form the total bill.

The most important aspects of your energy bill are:

- Unit rate

- Standing charge

- Contract End Date

There are, however, other costs to.

What you see on your business energy bill

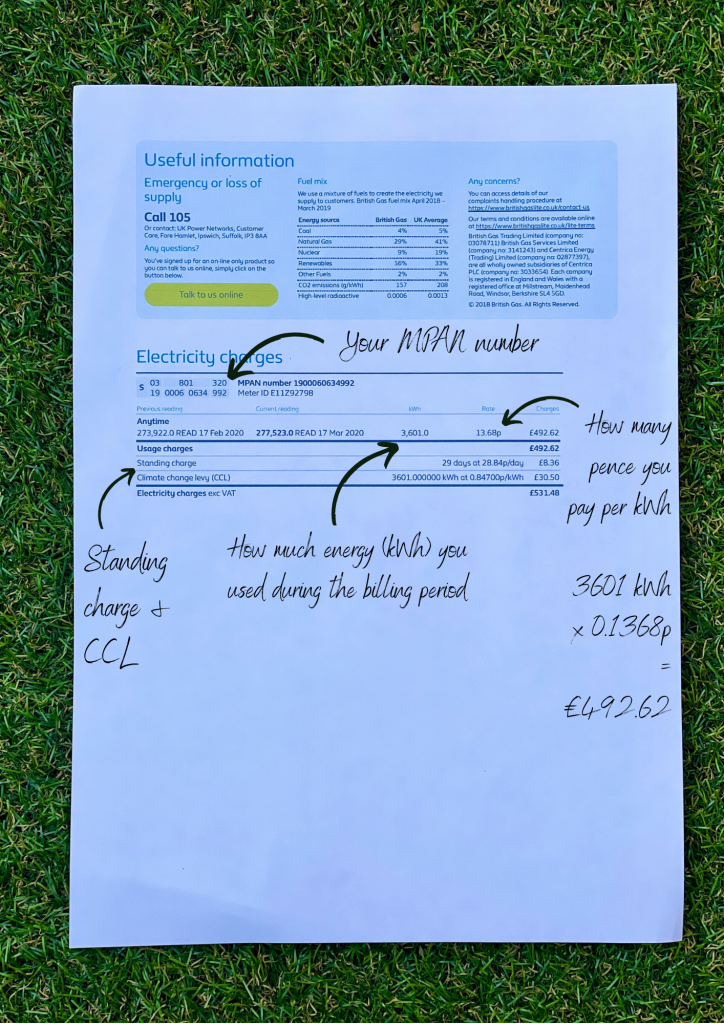

MPAN or MRPN – Your Meter Point Administration Number (MPAN) number for electricity, and your Meter Point Reference Number (MPRN) number for gas. These numbers are the unique numbers that identify the meter at your premises.

Unit Rate – The rate you pay for each kilowatt hour (kWh) of electricity or gas you use.

Standing Charge – You will pay this each and every day, regardless of how much energy you use.

Contract End Date – It is now mandatory that suppliers show your contract end date on your bill. This is the date you are free to move away from your existing supplier and your current fixed price period ends. Business energy is completely different to domestic energy, you cannot switch your business energy supplier mid-term.

Type of read – This will tell you whether your bill is based on an actual read or an estimate. To ensure accurate billing ensure you submit a regular meter read to your energy supplier.

Climate Change Levy (CCL) – Climate Change Levy or CCL, is a tax added by the government, for every unit (kWh) of non-renewable energy your business uses.If your business uses less than an average of 33 kWh of electricity a day (12,045 kWh a year) or 145 kWh of gas a day(52,925 kWh a year), you will not have to not pay CCL. This also applies if you have a domestic or residential element to your business i.e care homes or B&B’s.

VAT – Typically 20% VAT is charged on your business energy bill. If your business uses less than an average of 33 kWh of electricity a day (12,045 kWh a year) or 145 kWh of gas a day(52,925 kWh a year),you will only need to pay 5%. This also applies if you have a domestic or residential element to your business.

Here is a handy snapshot of a British Gas Lite Electricity Bill: